Stablecoins are rapidly becoming a cornerstone of the global financial ecosystem, particularly in Latin America, where they address issues like inflation, currency volatility, and inefficiencies in traditional banking systems. However, their adoption depends on regulatory frameworks that vary widely across countries.

Brazil, for example, stands out as a regional pioneer with a regulatory landscape that actively supports digital currencies. In 2022, the Central Bank of Brazil implemented the Crypto Assets Law, establishing clear guidelines for the issuance and use of stablecoins while prioritizing anti-money laundering (AML) measures. Additionally, specific rules for virtual assets are expected by 2025, cementing Brazil’s leadership in blockchain innovation.

In Argentina, stablecoins offer a critical solution amid annual inflation exceeding 100%. However, restrictive government policies have hindered widespread adoption. In 2023, authorities extended a ban on crypto services through banks and payment providers, highlighting the challenges of implementing blockchain technologies in fragile economies.

On the other hand, Mexico introduced its Fintech Law in 2017, providing a regulatory foundation for digital assets. However, the lack of specific guidelines for stablecoins creates uncertainty. Despite this, Mexico's position as the second-largest remittance market in the world underscores its potential to integrate this technology into cross-border transactions, including at the business level.

In Colombia, the government has demonstrated a forward-looking approach with initiatives like the interoperable Bre-B payment system. However, the absence of specific stablecoin regulations presents significant obstacles for businesses looking to adopt these technologies.

This regulatory diversity impacts the implementation of cross-border payments and innovation in this space. Each country takes a distinct stance on integrating blockchain-based solutions, making it crucial to understand these regional differences.

Regional Contex

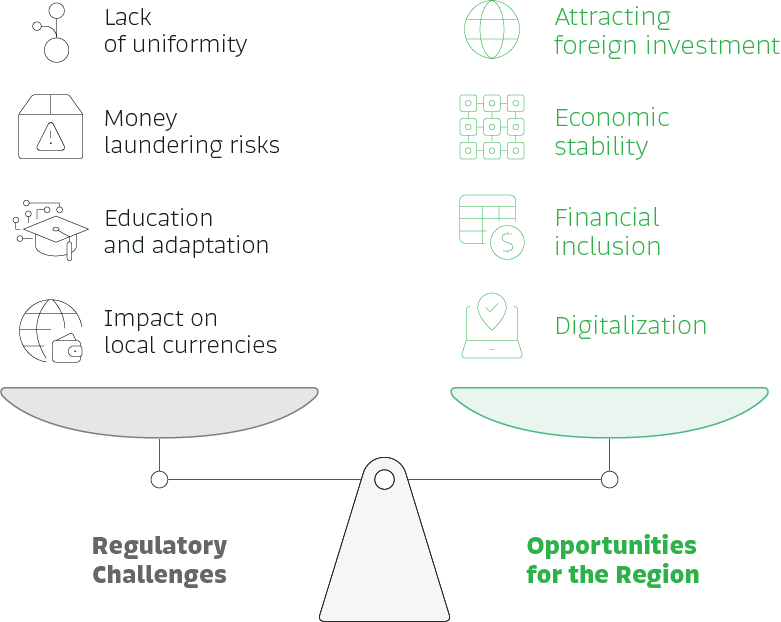

Regulatory Challenges

- Lack of uniformity: Discrepancies between countries hinder regional adoption and create uncertainty for businesses operating in multiple markets.

- Money laundering risks: The digital nature of stablecoins raises concerns about money laundering and illicit financing.

- Education and adaptation: Many regulators lack the knowledge required to effectively understand and oversee these assets.

- Impact on local currencies: The popularity of stablecoins pegged to foreign currencies could affect the stability of local currencies, prompting resistance.

Opportunities for the Region

- Attracting foreign investment: Clear and favorable regulation could position the region as a hub for financial innovation.

- Economic stability: Stablecoins can mitigate the effects of inflation and currency volatility in fragile economies.

- Financial inclusion: Regulation can facilitate access to advanced financial tools for a broader population.

- Digitalization: Promoting stablecoin usage can accelerate the digital transformation of local financial systems.

The Path Forward

For stablecoins to reach their potential in Latin America, policymakers and industry leaders must:

- Harmonize Regulations: Develop consistent regional standards to facilitate cross-border payments.

- Invest in Education: Equip regulators with the knowledge and tools necessary to effectively oversee blockchain technologies.

- Foster Innovation: Provide tax incentives and technological support to promote blockchain.

While the challenges are significant, the opportunities stablecoins present for Latin America are immense. Proper regulation could not only boost adoption but also transform the region’s economy. As governments and businesses collaborate to overcome obstacles, stablecoins could play a key role in economic integration and financial modernization.

For businesses, stablecoins can be a strategic tool to overcome the challenges of traditional financial systems in Latin America. The key lies in identifying areas where these digital assets add the most value, such as optimizing payments to international suppliers or mitigating currency risks. With increasingly clear regulatory frameworks in key regional markets, now is the ideal time to explore how to integrate stablecoins into your financial strategy. Bitso Business is ready to lead this transformation, bridging gaps in cross-border payments and empowering businesses to thrive in a digital economy.

This article is based on the report “From Barriers to Bridges: How Blockchain Can Reshape Cross-Border Payments in Latin America.”, recently published in collaboration with PCMI, our commercial partner specializing in market intelligence consulting in the global payments industry.

Explore our full report here and prepare your business to compete in an increasingly digital world.

You may also like

These related stories

Four Key Solutions Using Blockchain Technology

Stablecoins: The Key to Revolutionizing International Payments