How are Fintechs changing the financial services ecosystem?

The fintech sector has rapidly evolved in recent years, driving the creation of global platforms that are transforming how businesses manage payments and international transactions. Bitso Business is at the forefront of this transformation, offering solutions that enhance efficiency and scalability in cross-border payments for money transmitters and payment service providers (PSPs).

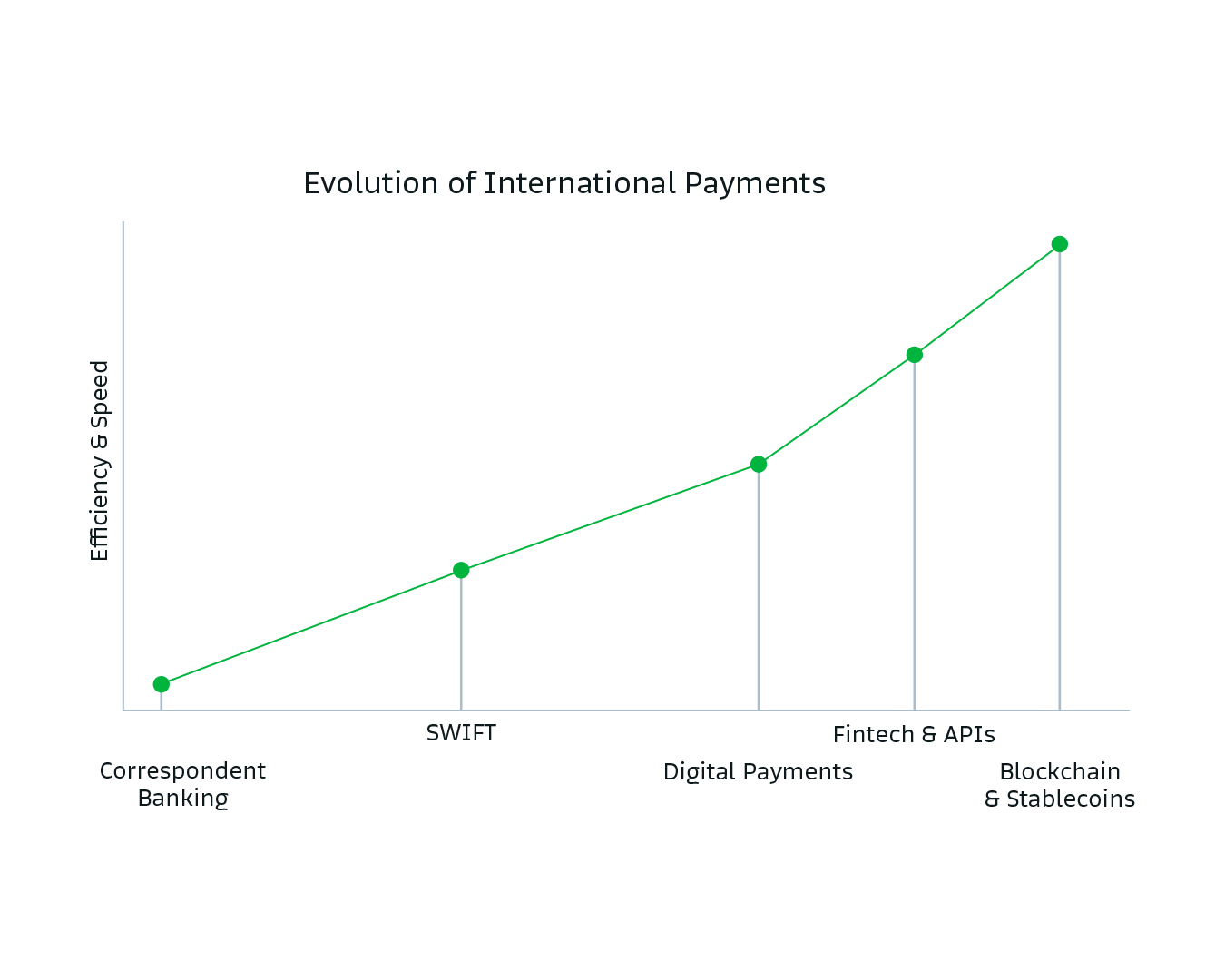

The Evolution of Cross-Border Payments

Historically, cross-border payments have relied on traditional banking networks, which involve high costs and long settlement times. However, the adoption of stablecoins and blockchain technologies is enabling more efficient, secure, and transparent payments by eliminating unnecessary intermediaries and significantly reducing transaction costs.

Fintechs are breaking down these barriers with blockchain-based infrastructures and payment aggregation models that eliminate the need to pre-fund accounts in each country. For money transmitters, Bitso Business enhances capital efficiency and significantly reduces operational costs. Meanwhile, PSPs can integrate solutions that optimize their customers' payment experiences, offering real-time settlements and multi-currency compatibility without the risks associated with crypto asset volatility.

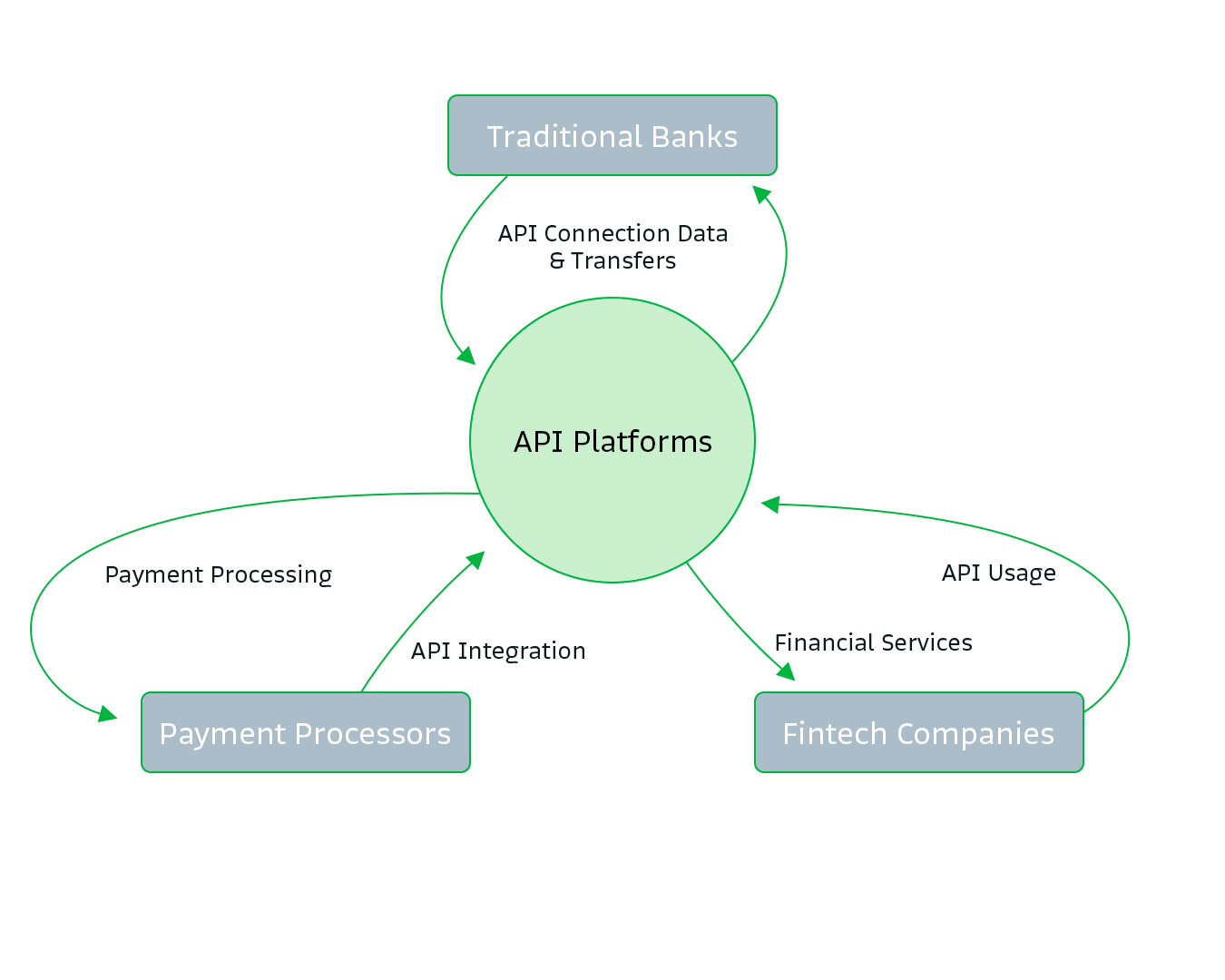

APIs and Scalable Infrastructure

Fintechs are developing flexible APIs that allow businesses to connect with different payment systems across multiple markets without the need to build costly in-house solutions. This not only reduces time-to-market but also facilitates adaptation to new regulatory frameworks.

For money transmitters, this interoperability means the ability to expand into new markets with less friction and improved regulatory compliance. For PSPs, integration with these platforms allows them to offer local payment methods in different regions through a single connection point, ensuring a seamless and compliant payment experience.

Security, Compliance, and Reliability

The rise of global platforms has also introduced new challenges related to security and regulation. Bitso Business adheres to strict compliance models aligned with both local and international regulations, ensuring user trust and operational continuity.

For money transmitters, partnering with Bitso Business reduces compliance risks, as the company holds licenses and direct banking connections across key Latin American markets. For PSPs, leveraging certified solutions ensures secure and transparent transactions for their enterprise clients.

The Future of Global Financial Services

The fintech ecosystem is redefining how businesses manage international payments. With scalable infrastructures, API-driven integrations, and robust compliance frameworks, money transmitters and PSPs are achieving greater efficiency, cost reductions, and market expansion.

Global platforms, led by Bitso Business, are not only streamlining cross-border payments but also paving the way for a more agile, transparent, and accessible financial system.

In an environment where speed, efficiency, and regulatory compliance are critical, staying informed about the evolution of cross-border payments and the technologies driving them is essential for businesses looking to remain competitive. For money transmitters and PSPs, understanding how fintechs are transforming global financial infrastructure with solutions like stablecoins, scalable APIs, and non-pre-funded payment models is key to optimizing costs, accelerating settlement times, and ensuring operational security.

Bitso Business is leading this transformation, providing the necessary tools for businesses to adopt an innovative and reliable approach to international payments. Staying ahead of industry developments not only enables companies to anticipate market changes but also helps identify strategic opportunities that can drive global expansion and operational efficiency. In a constantly evolving financial landscape, knowledge remains the most powerful competitive advantage.

You may also like

These related stories

.jpg?width=1920&height=1080&name=1920x1080_CONTENT%20HUB_LO%20QUE%20ENCONTRAR%C3%81S%20EN%20CH_%20(1).jpg)

What you will find in our new Content Hub

.png?width=1920&height=1080&name=20250415_Bitso_Blog_StablecoinBasedFinancialStrategies-Cover-1920x1080%20(1).png)

Stablecoins in action: The new financial edge for global enterprises

.png?width=1920&height=1080&name=20250303_Bitso-Blog_IAinFintechs-Cover-1920x1080%20(1).png)